In the world of luxury timepieces, not all watches are created equal when it comes to retaining—or even appreciating in—value. While passionate collectors often emphasize buying watches you love rather than treating them purely as investments, it’s undeniably satisfying when a treasured timepiece maintains or increases its worth over the years.

The good news? You don’t need to spend five or six figures to find watches with strong value retention. From entry-level luxury pieces to grail watches, this guide explores timepieces at various price points that have historically demonstrated strong performance in the secondary market.

What Makes a Watch Hold Its Value?

Before diving into specific recommendations, it’s important to understand the factors that contribute to a watch’s ability to maintain its value:

Brand Heritage and Prestige

Established luxury brands with long histories of exceptional craftsmanship tend to hold value better than newer, less proven manufacturers. The strongest performers typically have decades (or even centuries) of watchmaking heritage.

Supply and Demand Dynamics

When demand significantly outstrips supply, prices naturally rise. This explains why discontinued models or limited production pieces often perform exceptionally well in the secondary market.

Design Timelessness

Watches with classic, timeless designs tend to maintain their appeal (and value) longer than those with trendy aesthetics that may quickly fall out of favor.

Condition and Provenance

Original boxes, papers, and service history significantly impact resale value, as does the overall condition of the watch.

Material Value

Watches made from precious metals (particularly gold and platinum) have inherent material value that provides a floor for potential depreciation.

Entry-Level Luxury ($1,000-$5,000)

Tudor Black Bay Fifty-Eight

The Tudor Black Bay Fifty-Eight represents one of the strongest value propositions in modern watchmaking. Tudor’s connection to Rolex provides brand prestige, while the Black Bay line’s vintage-inspired aesthetics offer timeless appeal.

Since its introduction in 2018, the Black Bay Fifty-Eight has consistently commanded prices at or above retail on the secondary market, particularly for the blue variant and limited editions. While the premium has cooled slightly in recent years, these watches continue to retain approximately 90-100% of their retail value.

Key factors in its value retention include:

- Tudor’s association with Rolex

- Limited production relative to demand

- In-house movement

- Versatile 39mm case size that appeals to a wide range of collectors

Oris Aquis Date

For those with a more modest budget, the Oris Aquis Date represents a smart choice. While Oris watches typically experience initial depreciation of 20-30%, they tend to stabilize at that level rather than continuing to lose value.

The Aquis in particular has shown stronger performance than many competitors in its price range, thanks to its distinctive design, build quality, and Oris’s growing prestige among enthusiasts.

Longines Legend Diver

Longines has been experiencing something of a renaissance in recent years, with their heritage-inspired pieces receiving particular acclaim. The Legend Diver, based on a 1960s compressor-style dive watch, has become a modern classic that tends to hold approximately 70-80% of its retail value.

Limited editions, such as the bronze variant or models with colored dials, have shown even stronger performance in the secondary market.

Mid-Range Luxury ($5,000-$10,000)

Omega Speedmaster Professional “Moonwatch”

Few watches have the historical significance of the Omega Speedmaster Professional. As the first watch worn on the moon, the “Moonwatch” has secured its place in horological history.

The Speedmaster Professional has demonstrated remarkable stability in the secondary market, typically retaining 80-90% of its retail value. Limited editions and vintage references often appreciate significantly, particularly those marking important Apollo mission anniversaries.

The 2021 update featuring the Co-Axial Master Chronometer Calibre 3861 has reinforced the Speedmaster’s position as a solid value retention performer.

Zenith Chronomaster Original

Zenith’s El Primero movement has legendary status as one of the first automatic chronograph calibers, and watches powered by this iconic movement have shown strong value retention.

The Chronomaster Original, which closely resembles the original A386 from 1969, typically retains about 75-85% of its retail value on the secondary market—significantly better than many competitors in this price range.

Limited editions and special colorways have performed even better, sometimes trading above retail shortly after release.

Grand Seiko Snowflake (SBGA211)

Grand Seiko has built a devoted following for its exceptional finishing, innovative technology, and distinctive Japanese approach to luxury watchmaking. The “Snowflake,” with its unique textured dial inspired by winter landscapes in the Shinshu region, has become the brand’s most recognizable model.

While Grand Seiko watches typically experience initial depreciation of 20-30%, they tend to stabilize and sometimes appreciate over longer time horizons. The Snowflake, in particular, has shown stronger price stability than many other Grand Seiko models.

High-End Luxury ($10,000-$25,000)

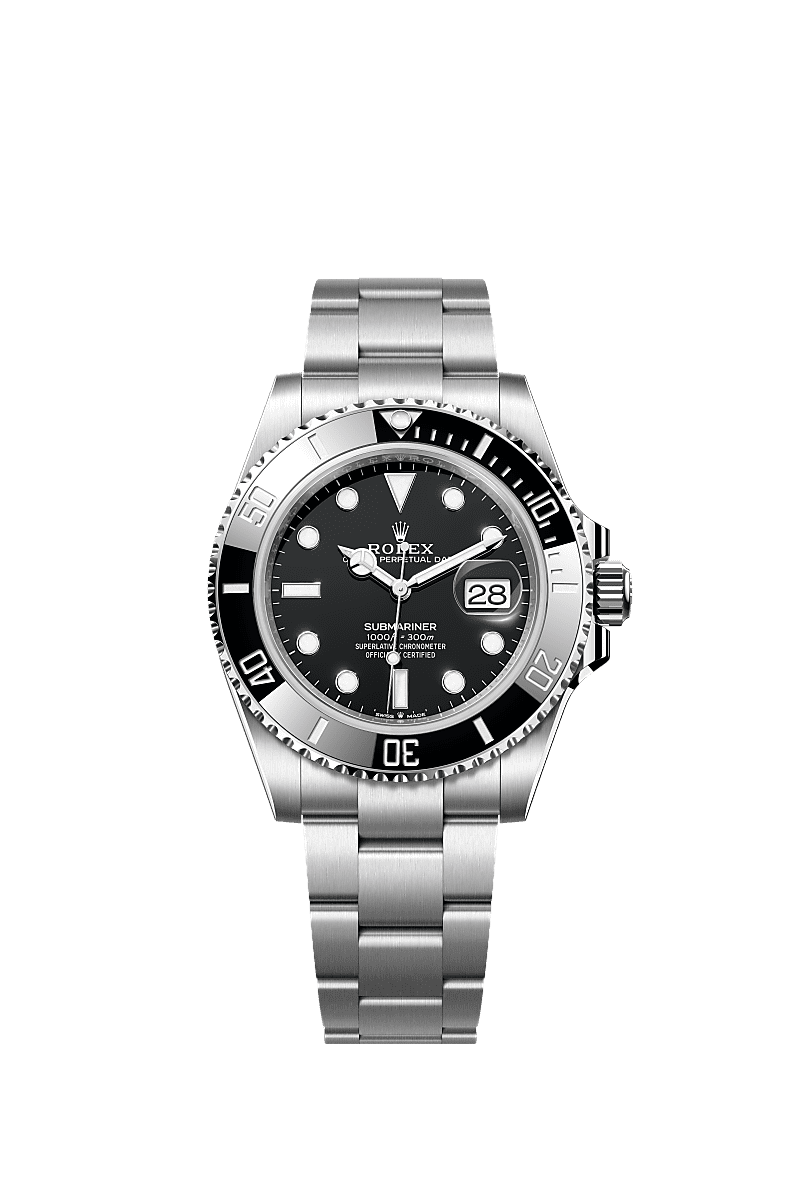

Rolex Submariner

The Rolex Submariner remains the quintessential luxury sports watch and one of the strongest performers for value retention. Current models typically trade at 20-40% above retail on the secondary market, primarily due to limited availability at authorized dealers.

Even during market downturns, the Submariner has historically maintained strong value retention, rarely dropping below retail price. This stability makes it one of the safest watch “investments” available.

Key factors in its exceptional performance include:

- Controlled production and distribution

- Universal recognition of the Rolex brand

- Timeless design that has evolved only subtly since the 1950s

- Excellent build quality and durability

Audemars Piguet Royal Oak

The Audemars Piguet Royal Oak, designed by Gerald Genta in 1972, revolutionized luxury watchmaking by introducing the concept of the luxury sports watch in stainless steel.

Today, most Royal Oak models trade significantly above their retail prices on the secondary market, with premiums ranging from 20% to over 100% depending on the specific reference. The 15500 and 15400 references in stainless steel have been particularly strong performers.

Patek Philippe Aquanaut

The Aquanaut has emerged from the shadow of its more famous sibling, the Nautilus, to become one of Patek Philippe’s most sought-after models. The reference 5167A (stainless steel with black dial) typically trades at a 50-100% premium to its retail price.

Like other Patek Philippe sports watches, the Aquanaut benefits from limited production, growing demand, and the prestige of the Patek Philippe brand.

Ultra-Luxury Timepieces ($25,000+)

Patek Philippe Nautilus

The Patek Philippe Nautilus, particularly the now-discontinued reference 5711 in stainless steel, has become the poster child for watch market appreciation. At its peak, the 5711 was trading at nearly three times its retail price on the secondary market.

While the premium has cooled somewhat, the Nautilus remains a strong performer, with most models trading significantly above retail. The recent introduction of the 5811 in white gold has maintained the collection’s exclusive positioning.

F.P. Journe Chronomètre Bleu

Independent watchmaker François-Paul Journe has built an extraordinary reputation for his technical innovations and distinctive aesthetic. The Chronomètre Bleu, with its tantalum case and mesmerizing blue dial, has become one of the most coveted pieces from any independent watchmaker.

Originally retailing for around $20,000 when introduced in 2009, the Chronomètre Bleu now regularly trades hands for more than $50,000 on the secondary market, making it one of the strongest performing watches of the past decade.

A. Lange & Söhne Lange 1

The Lange 1, with its distinctive asymmetric dial layout, has become the signature model of German high-end watchmaker A. Lange & Söhne. While Lange watches typically experience some initial depreciation, they tend to stabilize and sometimes appreciate over the long term.

Limited editions and discontinued models, particularly those in platinum cases, have shown the strongest performance in the secondary market.

Emerging Contenders

Ming

Founded in 2017, Ming has quickly established itself as one of the most exciting new watchmakers. Their limited production models typically sell out instantly and often trade at premiums on the secondary market.

The Ming 17.09 and 27.01, in particular, have shown strong initial value retention, suggesting that carefully selected pieces from emerging independent watchmakers can be both aesthetically rewarding and financially sound acquisitions.

Kurono Tokyo

Hajime Asaoka’s more accessible brand, Kurono Tokyo, releases limited edition watches that sell out within minutes. Models like the Chronograph 2 and the anniversary series have traded at significant premiums shortly after release.

While it’s too early to assess long-term value retention, the initial performance suggests that limited production watches from respected independents with distinctive designs can perform exceptionally well.

Tips for Value-Conscious Collectors

If value retention is an important consideration in your watch purchasing decisions, keep these principles in mind:

Buy at Retail When Possible

For sought-after models from brands like Rolex, Patek Philippe, and Audemars Piguet, purchasing at retail price provides an immediate “equity cushion” given current secondary market premiums.

Focus on Classics Over Trends

Watches with established design languages and long production histories tend to hold value better than novel or trendy designs.

Condition is Paramount

Keep all boxes, papers, and accessories. Have your watches serviced by authorized service centers, and maintain records of all services.

Consider Limited Editions Carefully

Not all limited editions perform equally well. Those that commemorate significant milestones or feature meaningful design changes tend to outperform simple color variations or co-branding exercises.

Look for Discontinued Models

When manufacturers announce the discontinuation of popular models, prices often rise as collectors seek to acquire examples before they disappear from the market.

Conclusion: Passion with Purpose

While value retention can be an important consideration, the primary motivation for most watch collectors remains passion and appreciation for horological craftsmanship. The watches that tend to perform best financially are often those with genuine historical significance, technical innovation, or exceptional design—the very qualities that make watches appealing to enthusiasts in the first place.

By focusing on quality, rarity, and timeless design, it’s possible to build a collection that provides both aesthetic enjoyment and financial stability. The watches highlighted above represent some of the stronger performers in their respective price categories, but remember that market conditions can change, and past performance doesn’t guarantee future results.

Ultimately, the best approach is to purchase watches that you genuinely love and would be happy to keep regardless of their financial performance. If they happen to maintain or increase their value over time, consider it a welcome bonus to the pleasure of owning and wearing a fine timepiece.